Understanding the IRA Required Minimum Distribution Worksheet: A Guide to IRS Compliance

BlogTable of Contents

- Ready to Retire - Really!: November 2015

- CHANGE TO IRA DISTRIBUTION RULES - Community Foundation of Northern ...

- Required Minimum IRA Distributions | Welch Olsen LLP

- Required Minimum Distribution Table For Inherited Ira | Elcho Table

- Inherited Ira Rmd Table 2018 | Elcho Table

- Ira Mandatory Distribution Table | Brokeasshome.com

- Beneficiary Ira Mandatory Distribution Table | Elcho Table

- Calculate Ira Minimum Distribution Table | Elcho Table

- Required Minimum IRA Distributions | Welch Olsen LLP

- Irs Uniform Lifetime Table Excel | Cabinets Matttroy

What are Required Minimum Distributions (RMDs)?

The IRA Required Minimum Distribution Worksheet

How to Use the IRA Required Minimum Distribution Worksheet

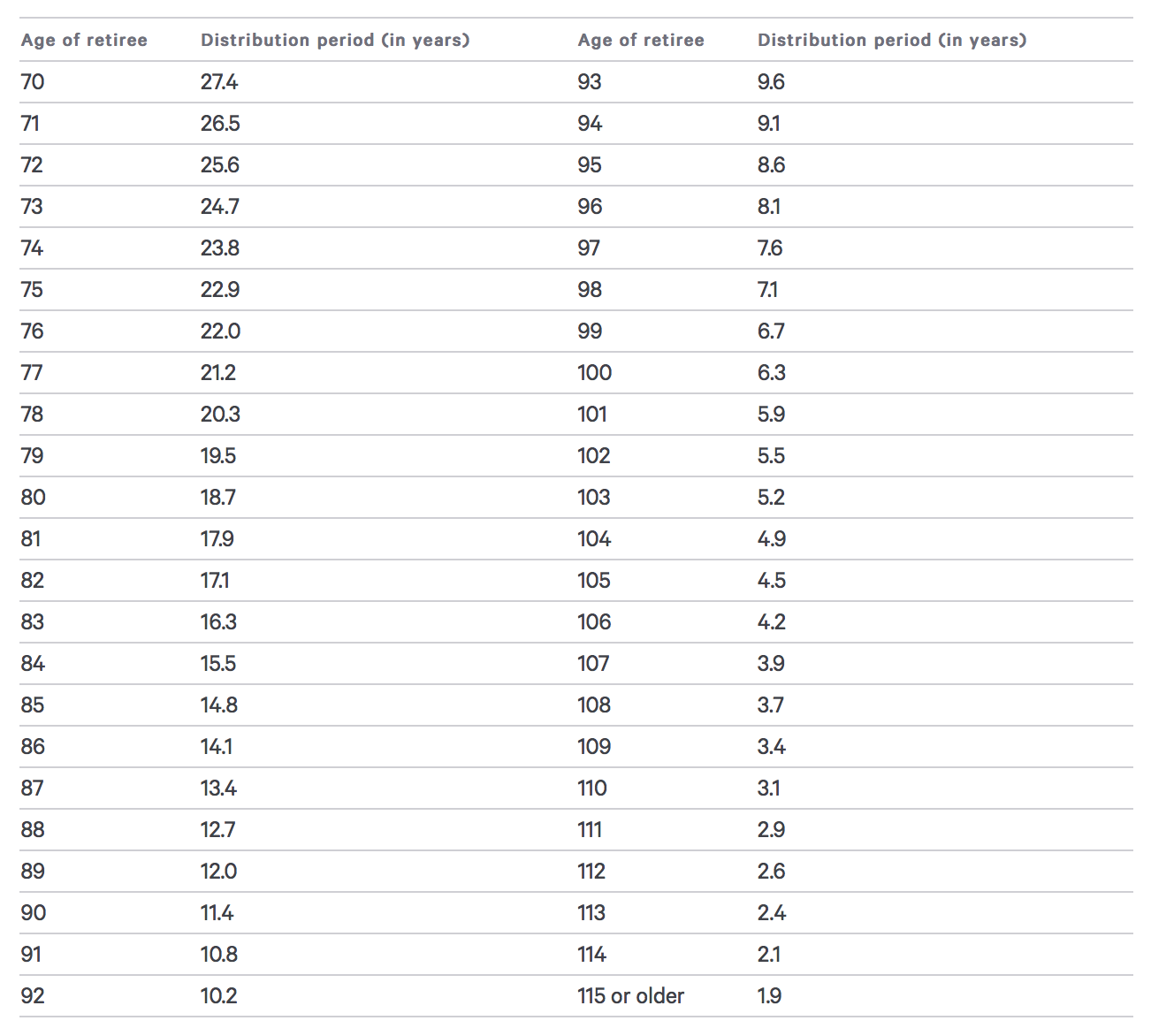

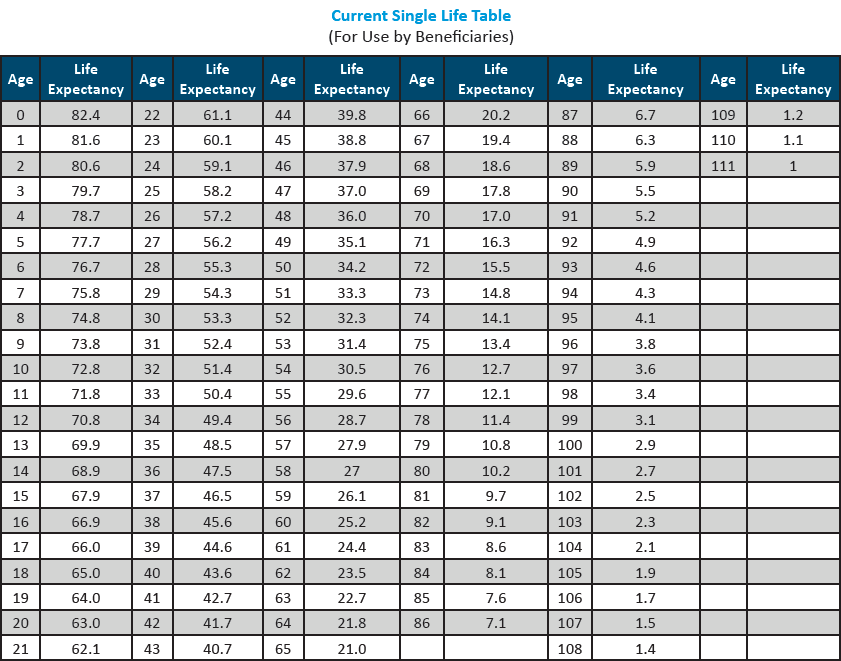

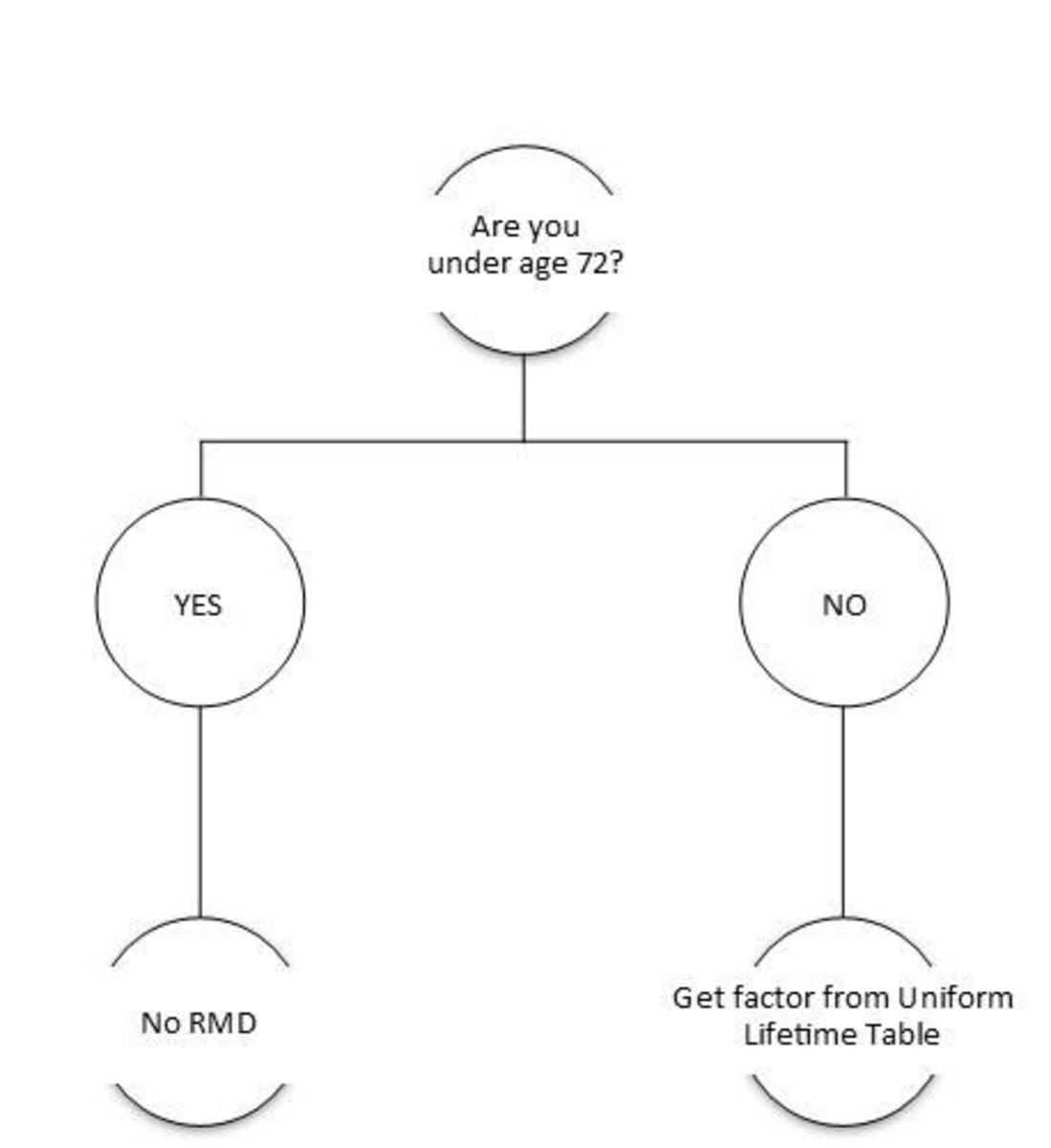

Using the worksheet is relatively straightforward. Here's a step-by-step guide: 1. Gather your account statements and determine your account balance as of December 31st of the previous year. 2. Use the Uniform Lifetime Table to find your life expectancy factor based on your age. 3. Divide your account balance by your life expectancy factor to calculate your RMD. 4. Review your calculation to ensure you're taking the correct amount.

Penalties for Not Taking RMDs

It's essential to take your RMDs on time to avoid penalties. If you fail to take your RMD, you may be subject to a 50% penalty on the amount you should have withdrawn. For example, if your RMD is $10,000 and you don't take it, you may be liable for a $5,000 penalty. Understanding the IRA required minimum distribution worksheet is crucial for ensuring compliance with IRS regulations. By using the worksheet and following the calculation steps, you can determine your RMD and avoid potential penalties. Remember to review your account balance, life expectancy factor, and RMD calculation annually to ensure you're meeting your obligations. If you're unsure about any aspect of the process, consider consulting with a financial advisor or tax professional. By taking control of your IRA RMDs, you can enjoy a more secure and predictable retirement, knowing that you're making the most of your hard-earned savings. Take the time to explore the IRS resources and worksheets available to you, and start planning for a brighter financial future today.Keyword: IRA required minimum distribution worksheet, Internal Revenue Service, RMD, retirement planning, IRS compliance