Target Corporation Stock Price Update: A Comprehensive Analysis

BlogTable of Contents

- Target Stock Gaps Higher on Earnings Beat

- Target Joins The Retailers Integrating Apple Pay

- Target stock photo. Image of target, center, color, sport - 25033160

- Target Stock's Miss May Take It a Mile (NYSE:TGT) | InvestorPlace

- 3 Reasons I Bought Target Stock This Month | The Motley Fool

- Is Target Stock a Buy on the Dip After Earnings? | Kiplinger

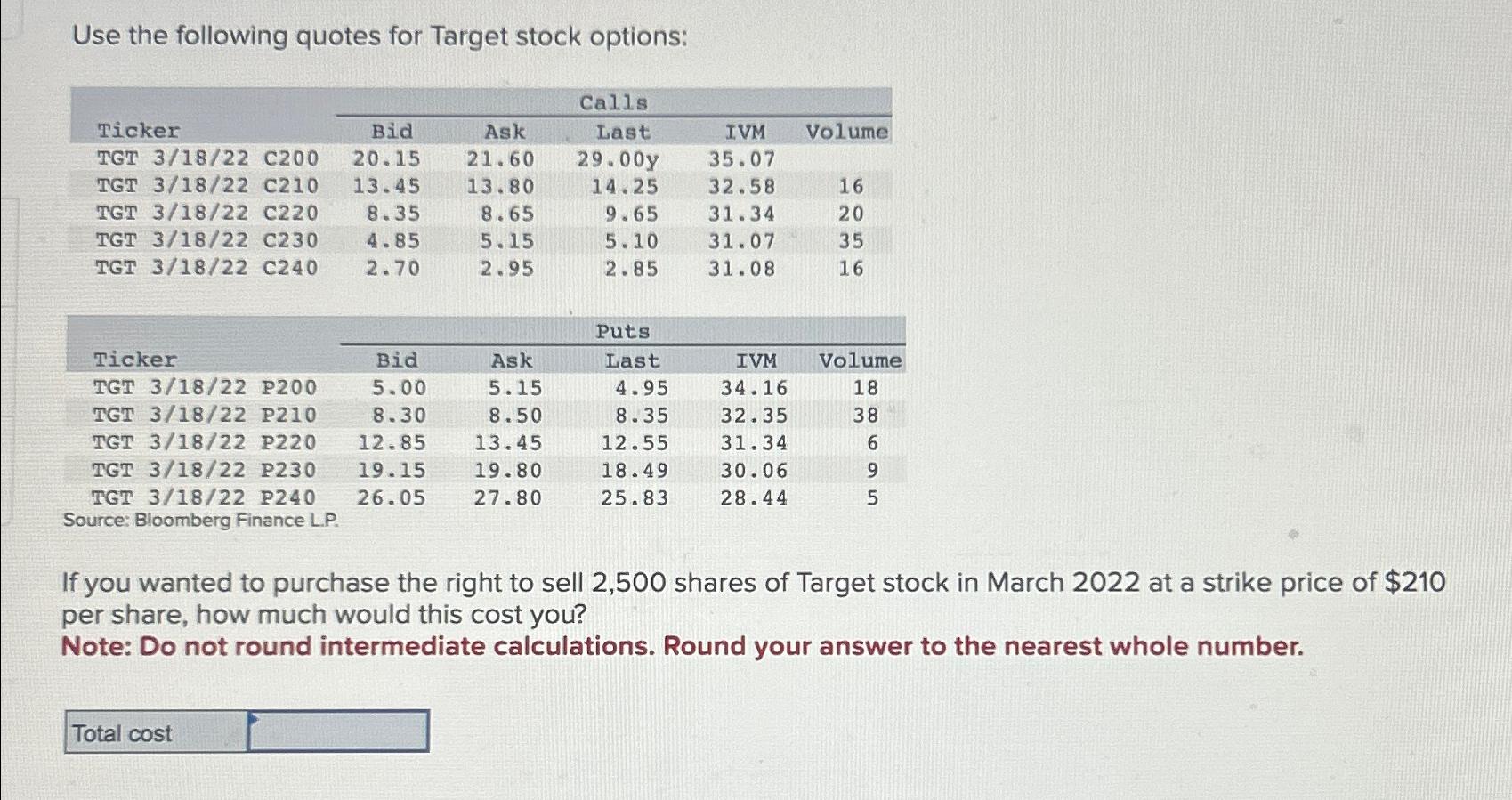

- Solved Use the following quotes for Target stock | Chegg.com

- Target Icon Black

- Target Stock Down After 1 Million Promise to Boycott - Family Policy ...

- Sales Target

Current Stock Price

Recent Performance

Analyst Estimates

Analysts are generally bullish on Target's stock, with many expecting the company to continue to perform well in the coming months. According to the WSJ, the consensus estimate for Target's earnings per share (EPS) is $X for the current fiscal year, representing a X% increase from the previous year. Many analysts have also raised their price targets for Target's stock, citing the company's strong sales growth and improving profitability. Some of the top analysts covering Target's stock include analyst names from firm names, who have assigned a "buy" rating to the stock.

Risks and Challenges

While Target's stock has been performing well, there are still risks and challenges that investors should be aware of. One of the main risks facing the company is increased competition from online retailers such as Amazon, which has been expanding its grocery delivery services and investing heavily in its retail business. Additionally, Target faces risks related to changes in consumer spending habits and preferences. The company has been working to adapt to these changes by investing in its e-commerce platform and expanding its services, but there is still uncertainty around how these efforts will pay off. In conclusion, Target Corporation's stock price has been performing well in recent months, driven by strong sales growth and improving profitability. While there are risks and challenges facing the company, many analysts are bullish on the stock and expect it to continue to perform well in the coming months. As always, investors should do their own research and consider their own risk tolerance before making any investment decisions. For the latest updates on Target Corporation's stock price and performance, be sure to check out the Wall Street Journal (WSJ) and other reputable financial news sources.Disclaimer: The information contained in this article is for general information purposes only and should not be considered as investment advice. The stock market can be volatile, and investors should always do their own research and consider their own risk tolerance before making any investment decisions.