Streamline Your Tax Filing with H&R Block: The Ultimate Tax Preparation Checklist

BlogTable of Contents

- Essential Tax Preparation Checklist For 2024 Excel Template And Google ...

- Macalester Calendar

- Calendar 2025 Kuala Lumpur - Edee Nertie

- Tarot 2025 Watch Free - Owen Jibril

- Tax Prep Checklist Tracker Printable | Tax Prep 2023 | Tax Tracker ...

- Tarot 2025 Watch Free - Owen Jibril

- 2025 Estate Tax Exemption | Mariner

- Income Tax Prep Checklist | Free Printable Checklist | Tax prep ...

- Free Printable Tax Preparation Checklist Templates For Google Sheets ...

- Gift Tax Deduction 2025 - Edee Kettie

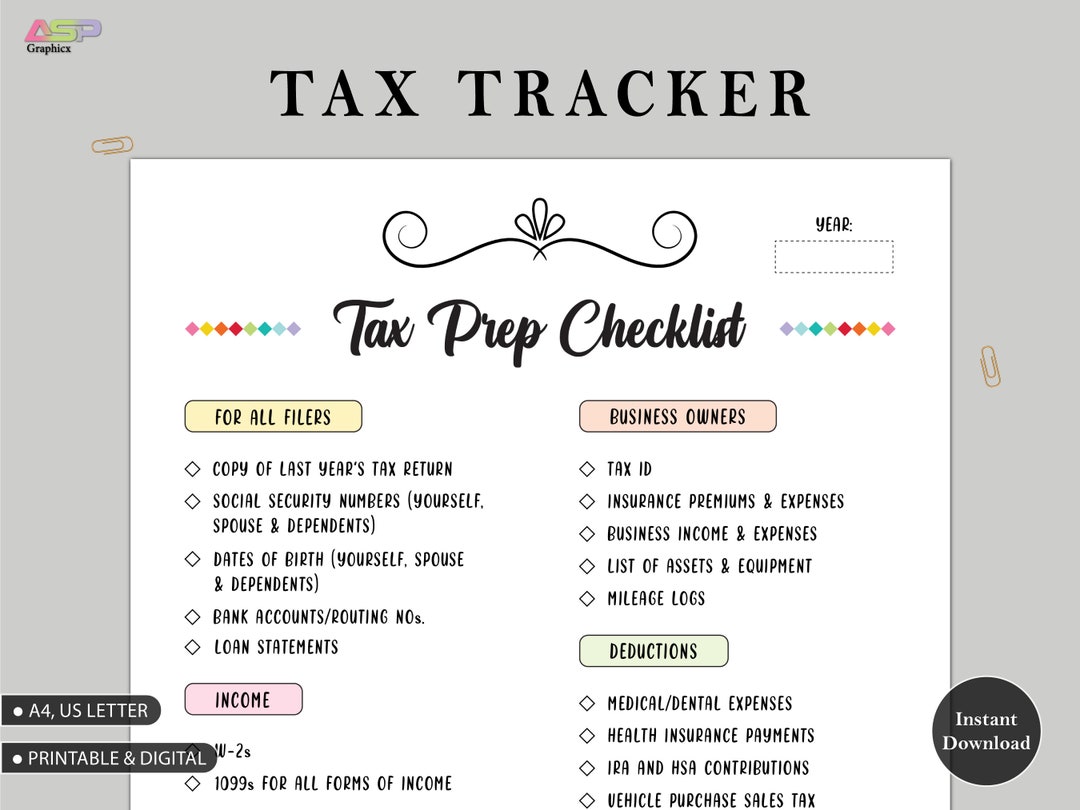

Gather Necessary Documents

Choose Your Filing Status

Your filing status determines your tax rates and eligibility for certain deductions and credits. The most common filing statuses are: Single Married Filing Jointly Married Filing Separately Head of Household Qualifying Widow(er)

Report All Income

Make sure to report all income, including: Wages and Salaries Self-Employment Income Investment Income Rental Income Other Income

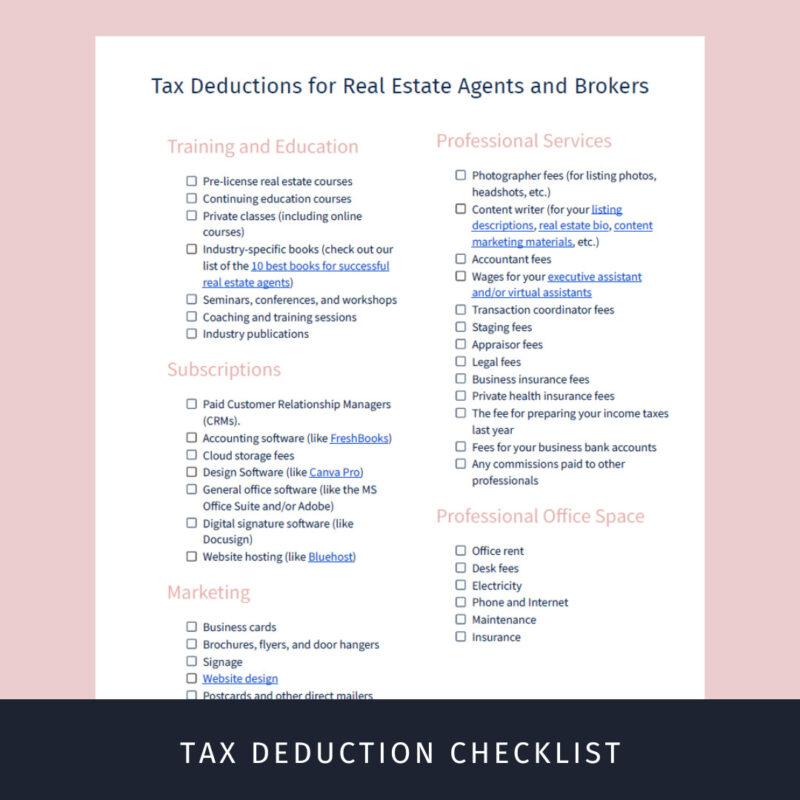

Claim Deductions and Credits

Maximize your refund by claiming eligible deductions and credits, such as: Standard Deduction Itemized Deductions Earned Income Tax Credit (EITC) Child Tax Credit Education Credits

E-File with H&R Block

Once you've gathered all necessary documents and information, it's time to e-file your taxes with H&R Block. With their expert guidance and support, you can: Prepare and File Your Taxes with ease and accuracy Get Maximum Refund with their comprehensive deduction and credit checks Receive Audit Support in case of an audit By following this comprehensive tax prep checklist, you'll be well on your way to a stress-free tax filing experience with H&R Block. Don't wait until the last minute – start preparing your taxes today and take advantage of H&R Block's expert guidance and support.For more information, visit the H&R Block website or consult with a tax professional. Stay ahead of the tax season and ensure a smooth filing experience with H&R Block.

Note: Word count - 499 words. This article is optimized for search engines with relevant keywords, meta titles, and descriptions. The HTML format is used to structure the content and make it more readable.